Tags

2017, allocation strategy, investing, investment, mutual fund, mutual fund investment, mutual funds, mutual funds investment, portfolio allocation, portfolio rebalancing, q&a

This is a follow up post on the previous one, as the post is getting pretty long. I’m going to quote directly from stephen’s questions instead.

“Let say after I buy a few unit trust, What is key point to look for to avoid loss in unit trust?” – quoted from comment

There’s always risk involved in investing, the only thing we can do is minimize it according to our risk appetite/tolerance. I always believe in doing the homework before making the decision, in this case will be going through the prospectus, reports and performance history of the fund that you are interested in. (1) By doing so, you will understand the investing philosophy of the fund manager & his/her team. (2) Then, I will look at the macro level of the target market (e.g. geography, industry, instruments), and identify its trend.

These 2 pieces of information will be crosschecked, and once the decision is made, you have to understand your investing term (short, medium or long). After the purchase, the periodic follow-up actions are reviewing the trend periodically, if the trend doesn’t change, I will just keep the fund invested reaches my plan.

“how monitor the unit trust and action taken when needed? I dun understand this part because I heard there many people losing money in unit trust, can give example on this part how avoid losing money?” – quoted from comment

Referring to the previous answer, before making the purchase, I will have the following information of the fund before making the final decision:

- Investing philosophy (growth, value…etc)

- Financial instruments (equity, income-based, balanced..etc)

- Focus market, could be geographical (europe, asia, malaysia…etc), or types (equities, income..etc), or sectors (consumer, industry, financial…etc)

- Focus market macro trend, could be geographical (europe, asia, malaysia…etc), or types (equities, income..etc), or sectors (consumer, industry, financial…etc)

- Annual Expense ratio / Charges (annual management fees, sales charge, loading..etc)

- Investment period for the specific fund (how long you plan to keep invested in this fund?)

- Do you have a return goal for the specific fund? (5% / 10%)

- Do you have any stop-loss in mind for the fund? If yes, what is it.

When I have all these information, I will proceed to make the decision. A general guideline that I follow it myself, :

- Overall market trend shall favor the fund’s focus, e.g. small-cap focused fund when huge inflow of hot money into the system.

- Expense ratio shall be below 2% (if there’s list of funds being decided upon, I will choose the lowest, with all the other things considered)

- The impact of this fund to my overall portfolio allocation strategy.

“Also, may I know how re-balancing whenever needed like there are major movements on the market? Let say the nav price is down, do I need to sell my unit trust or switch to other fund?” – quoted from comment

For rebalancing, I will first identify my portfolio allocation for the year. For example, currently I’m doing 70% equities and 30% fixed income, overweight on equities. This decision is based on several factor, (1) macro economic condition, whether it’s a equities run or not, (2) my risk appetite, aiming for higher risk higher return, thus overweight on equities.

With this identified and planned, I will look into populating the allocation with funds that follow the above criteria. When this is done, then I will typically revisit the allocation at least once a year by checking if the allocation has skewed. Then I will re-balance by selling some and buying others. Similarly, if major quake in the financial market, i.e. Sub-prime crisis, you can choose to take defensive position by switching to 70% fixed income and 30% equities.

If NAV is down, first thing I do is to understand what causes that, whether if this is an industry wide problem, like gold & precious metals sector due to strengthening US dollars. If it’s industry wide, then I will have to research and decide if it will make a come back.

One rule I remind myself, selling the fund means I’m locking in either positive or negative returns. Unless I see no possible come back of the fund, otherwise I will hold it out, as in the case of CIMB-Principal Greater China from -16% and after ~11 months, I’m locking in +8% eventually.

“Lastly, I would like to know Public Balance Fund performance(my father invest this fund long time ago), can i continue keeping this fund or switch other public mutual fund? If yes, any recommendation.” – quoted from comment

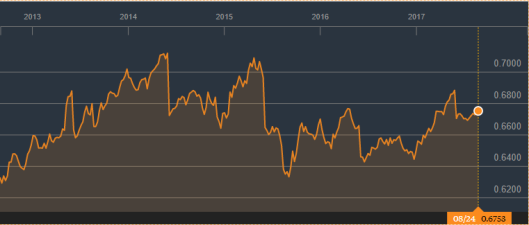

Depending on when it was invested, you might have made some returns. I only found information from 5 years ago, and it’s return chart is as follow. The fund does give out dividends though.

You can always check with your agent (if you are on Public Mutual), ask for his/her recommendation following your risk profile. And I would highly suggest you do the research with information provided by the agent before making up your mind.

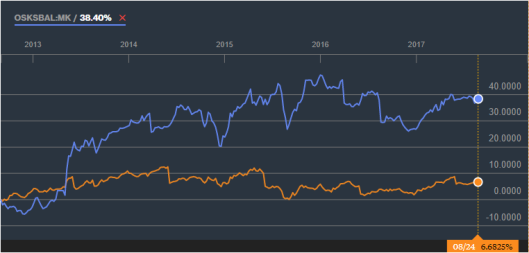

Purely from a very shallow comparison, the RHB Smart Balanced did better within the same time frame, as shown below.

There’s numerous reason that could cause the deviation, thus to properly understand the difference, you would need to dig into their respective investing philosophy as well as their specific holdings.