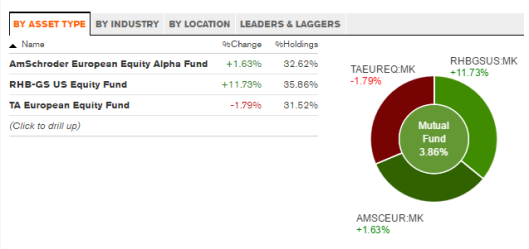

Over the course of 1 month, and the announcement of the monetary easing policy by ECB, I’ve made another purchase of fund related to Europe market. In summary, below is the breakdown of the portfolio, and its respective ROI so far. Both EU funds are pretty new, and US is exactly 1 year old as the time of this writing.

The initial investment of all the fund are same, however due to the positive return of 11.73% on the US fund, the overall allocation is slightly skewed to the US fund, RHB-GS US Equity Fund.

Taking into consideration of the front loading of 2% on the funds, AmSchroder European Equity Alpha Fund is doing OK, with 3.63%. Bound with structural problems on EU southern countries such as Greece, Italy and Spain, the overall region isn’t doing well even though with a monetary easing policy in place. Greece’s future is currently in talk, and no matter what the outcome might be, I believe the news would definitely be something positive to the market. My personal opinion is the public are now confused and thus reluctant to make any financial move. Once the news are broken, people will start making their decisions and the current limbo stage would finally be broken free as well. And with active participation of the public in the markets, there will be movement and overall market will move ahead.

The latest fund in the portfolio is the TA European Equity Fund, and the reason I bought is simply because it’s European targeted, and its underlying holdings are various form of European index funds. It’s sort of a mother feeder fund to several underlying European funds. I’m putting high trust of the fund manager to be able to have a wide coverage of various European markets/index and thus, I can capture profits from a wide range of indexes appreciation.

Personally, I still have the hopes on US being the leader in the world markets, and driving growth overall, thus my exit target for the RHB-GS US Equity Fund is 15%. I will sell once I got that, and that’s firm. On the other hand, European funds are currently set at +/- 5%, as the checkpoint. I will only make decision to hold or sell when they hit those rates.